A Win for Brevard County Families and Beyond

As the new school year approaches in Brevard County, Florida families are gearing up for the annual ritual of back-to-school shopping. This year, Governor Ron DeSantis and the Florida Department of Revenue have made it easier for parents to prepare their children for success with the Back-to-School Sales Tax Holiday, now a permanent, month-long event running from August 1 through August 31, 2025. This initiative, signed into law through HB 7031 as part of a $1.3 billion tax relief package, offers significant savings on essential school supplies, clothing, and technology, easing the financial burden on families across the Space Coast and the state of Florida.

What is the Back-to-School Sales Tax Holiday?

The Back-to-School Sales Tax Holiday allows Florida shoppers to purchase qualifying school-related items without paying the state’s 6% sales tax, plus any applicable county surtax (which in Brevard County is 1%, making the total sales tax 7%). Unlike previous years, when the tax holiday lasted only a week or two and required annual re-authorization, this year’s holiday is a permanent fixture, running the entire month of August. This extended period provides families with greater flexibility to shop for essentials as the school year begins, with most Brevard County schools starting on August 11, 2025.

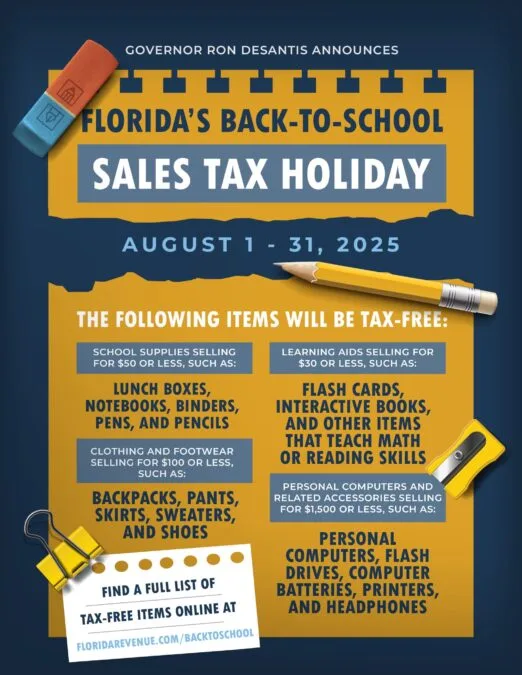

Qualifying items include:

- School supplies costing $50 or less (e.g., pencils, notebooks, calculators)

- Clothing, footwear, and accessories costing $100 or less (e.g., uniforms, shoes, backpacks)

- Learning aids costing $30 or less (e.g., flashcards, educational puzzles)

- Personal computers and accessories costing $1,500 or less (e.g., laptops, tablets, headphones, purchased for non-commercial use)

A complete list of tax-exempt items is available at floridarevenue.com/backtoschool.

The tax holiday applies to purchases made in-store, online, or through mail-order, as long as the order is accepted during August for immediate shipment.

Why a Tax Holiday?

The Back-to-School Sales Tax Holiday is designed to reduce the financial strain on families preparing for the school year. With the cost of school supplies rising—nationally, parents of K-12 students are expected to spend an average of $858 on clothes and supplies, while college student families may spend up to $1,326—the tax holiday offers meaningful relief. By eliminating sales tax on essential items, families can stretch their budgets further, ensuring students have the tools they need to succeed.

Governor DeSantis emphasized the significance of the savings, particularly for families purchasing big-ticket items like computers. “You’re talking about families that they got to buy a computer, they got to buy some of these things — that’s some significant savings,” he said at a press conference in Panama City Beach on July 28, 2025. He also highlighted the relatability of the back-to-school season for parents, noting, “We got a rising third grader, rising second grader, rising kindergartner. I think the First Lady and I are kind of at the point in the Summer where we’re looking forward to school.”

The decision to make the tax holiday permanent reflects a commitment to long-term support for families. “This is what we’re announcing today — something new for Florida,” DeSantis said. “It’s longer and permanent, which really makes a difference… It will be every August henceforth, unless the legislature tries to repeal it, which I don’t think they would.” This permanence ensures families can plan their budgets with confidence, knowing the tax break will be available every year.

Who Benefits?

Parents and Students

The primary beneficiaries are parents of school-aged children, from kindergarten through college. In Brevard County, where schools like Viera High, West Shore Jr./Sr. High, and Cocoa Beach Jr./Sr. High prepare to welcome students, the tax holiday helps families afford everything from crayons and backpacks to laptops and uniforms. Commissioner of Education Anastasios Kamoutsas, a father of four, underscored the emotional and financial relief this provides, stating, “As a father of four girls, I was extremely excited. It gives hope and peace to parents, knowing this is going to benefit them for years to come.” The tax holiday is projected to save Florida shoppers $217 million annually, with Brevard families reaping a share of those savings.

Educators

Teachers, who often dip into their own pockets to supply classrooms, also benefit. The tax holiday covers many classroom essentials, allowing educators to stock up on supplies like markers, paper, and art materials without the added tax burden.Retailers: Local businesses in Brevard County, from big-box stores like Walmart and Target to small shops in Melbourne and Titusville, see a surge in sales during August. The Florida Retail Federation notes that retailers often run additional promotions during the tax holiday, expecting large crowds. “This is always a very popular holiday for retailers,” said Lorena Holley, general counsel and vice president of the Florida Retail Federation.

The Community

The tax holiday stimulates the local economy by encouraging spending at Brevard businesses, supporting jobs and commerce. It also ensures students are better equipped for learning, which benefits schools and the broader community by fostering academic success.A Deeper Look: Benefits and CriticismsWhile the tax holiday is widely praised, some critics argue it falls short of broader tax relief promises. Initially, Governor DeSantis and House Speaker Danny Perez proposed a $5 billion tax package, including a sales tax rate cut and property tax rebates. These were scaled back in favor of targeted tax holidays, leading some to question the scope of the relief. The Institute on Taxation and Economic Policy argues that tax holidays primarily benefit wealthier families who can time their purchases, while those living paycheck to paycheck may not have the same flexibility.

However, Senate President Ben Albritton defended the permanent holiday, stating, “Creating a permanent tax holiday every August on clothing, shoes, school supplies, and personal computers expands our current holiday and creates a consistency that benefits both consumers and retailers.” For Brevard families, the month-long window offers ample opportunity to plan purchases, mitigating some of these concerns.

Tips for Brevard Parents

To make the most of the Back-to-School Sales Tax Holiday:Check the List: Visit floridarevenue.com/backtoschool for the full list of qualifying items. Note that items purchased in theme parks, entertainment complexes, or airports are not tax-exempt.

Shop Local

Support Brevard businesses like those in Historic Downtown Melbourne or The Avenue Viera to keep dollars in the community.

Plan Ahead: With the holiday running all of August, you can spread out purchases to avoid the rush. Online retailers collecting Florida sales tax also honor the exemption.

Save Receipts

If you need to exchange an item, no tax will be due if the exchange occurs after August, as long as the original purchase was tax-exempt.

A Bright Start for Brevard Students

The Back-to-School Sales Tax Holiday is more than a financial break—it’s a chance for Brevard County families to prepare their children for a successful school year without breaking the bank. As Jim Zingale, Executive Director of the Florida Department of Revenue, noted, “The Back to School Sales Tax Holiday is an excellent way for Florida families to save money on the supplies students need for a successful school year.”

Governor DeSantis summed it up best: “That’s some significant savings.” For Brevard parents, students, teachers, and businesses, this month-long tax holiday is a reason to head back to school with confidence and a little extra cash in their pockets. So, grab your shopping list, hit the stores, and take advantage of this opportunity to save while supporting our local community.

For more information, visit floridarevenue.com/backtoschool or contact your local Brevard County retailers for special promotions during the tax holiday.